DT&M Services Ltd

Transaction: Management Buy-Out

Sector: Manufacturing

Completed: October 2017

Meridian advised the Shareholders of Hampshire based DT&M Services Limited (“Diametric”) on their Secondary Management Buy-Out, supported by further investment from Meridian.

Meridian have been working alongside Diametric as Board members since 2015 following the completion of the original Management Buy-Out. Since then Diametric have undergone a funding restructure to simplify it’s corporate group and raise additional bank funding to support its growth plans.

Diametric has doubled it’s profits over the last two years going from EBITDA of £500k to c. £1.2m. The Secondary Management Buy-Out allows the Shareholders to de-risk, facilitating the retirement of one individual and offering management the opportunity to take a more active role in the strategic direction of the company.

Graham Steele, Managing Director of Diametric comments, “Without Meridian's pragmatic approach to our Secondary Management Buy-Out, I feel the outcome would have been very different. Their broad spectrum of knowledge on both the financial and legal matters enabled us to achieve a structure that was more beneficial to the management team. From our initial meetings, through to each subsequent deal day and their ongoing involvement, nothing has been too much trouble. If you’ve not yet signed on the dotted line, I would thoroughly recommend you meet with the Meridian team to ensure you have the best deal on the table.”

Philip Mettam, Director at Meridian who led the deal comments, “Diametric has been through considerable change in the last 24 months with growth of both revenue and profit margin. The Secondary Management Buy-Out represents a great opportunity for existing management to continue this journey.”

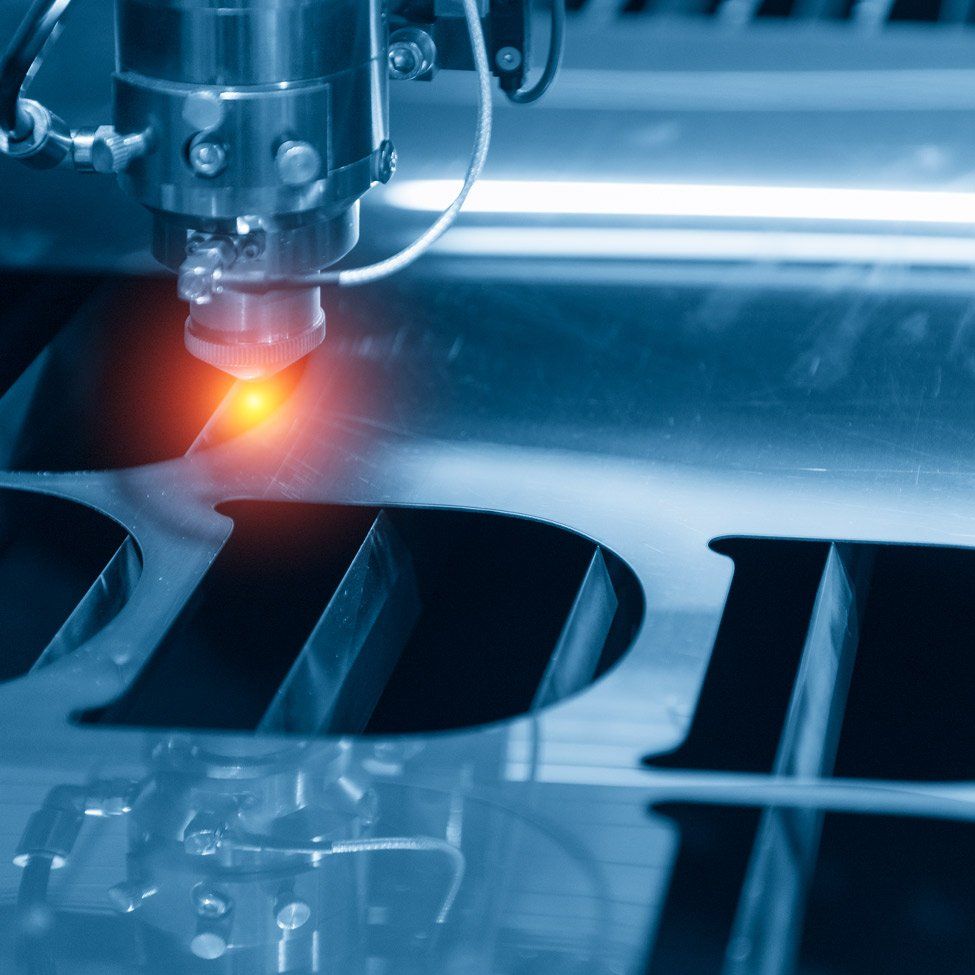

Diametric is a Swanmore and IoW based specialist design and manufacturing firm providing a range of badging and decals to manufacturers of consumer and commercial products.

The deal was supported by RBS and NatWest (Southampton), who provided funding and Trethowans LLP who provided legal advice.